This obligation comes from past events, for example, contracts or agreements.

Accrued Vacation: Definition, Meaning, Accounting, Journal Entry, Calculation, Example Companies pay compensation to their employees in many forms.For companies, these payments are expenses that fall. In exchange, employees receive salaries, wages, and other benefits.

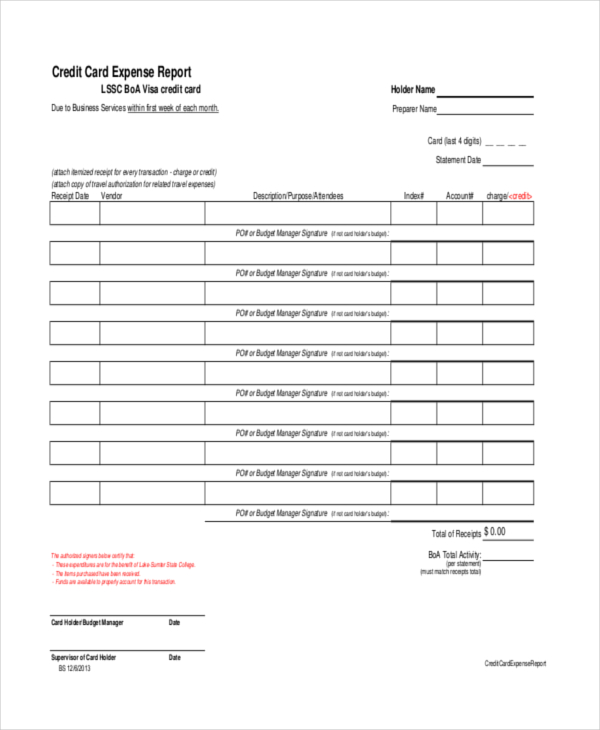

EXPENSE ACCOUNT HOW TO

Payroll Journal Entries: Accounting, Examples, Template, How to Record Companies and businesses employ several employees who perform tasks to achieve organizational goals.While many companies have adopted a model to promote remote work, one element has remained the same. Utility Expense: Definition, Accounting, Journal Entry, Example, Debit or Credit, Asset or Liability Companies need a base to operate in the business environment.The opposite is true for expenses and losses. Once again, debits to revenue/gain decrease the account while credits increase the account. For example, when a company records wages payable to employees, the journal entry is as follows. T Accounts for the Income Statement T Accounts are also used for income statement accounts as well, which include revenues, expenses, gains, and losses. However, the credit side may differ based on the type of expense getting recorded. The debit entry for the wages expense account is this account itself. The entry to recognize paying cash for salaries expense includes a (n) to the salaries expense account because expenses (increase/decrease) total stockholders equity. Expense accounts run the gamut from advertising expenses to payroll taxes to office supplies. Of all the accounts in your chart of accounts, your list of expense accounts will likely be the longest. It is a part of the requirement under the accruals concept in accounting. Expense accounts are items on an income statement that cannot be tied to the sale of an individual product. When these items accrue, companies must record them in the wages expense account. As stated above, these may include expenses, such as wages, taxes, benefits, etc. The journal entry for wages expense involves recording various items in the account. What is the journal entry for the Wages Expense Account? It may also impact the balance sheet if the wages and other expenses are payable later. The expense becomes a part of the income statement as a part of operating expenses. Usually, the accounting treatment in the wages expense account occurs through the accrual concept in accounting. The credit side includes the form of compensation. The wages expense account records these expenses through a debit entry.

0 kommentar(er)

0 kommentar(er)